Medicare Supplement Plan G

MEDICARE SUPPLEMENT PLAN G

Understanding the benefits and compare rates

Most companies use the attained age rating system. This means that where you live, your age and gender will be factored into your rates. We evaluated over 20 different companies for a female, non-tobacco user who qualifies for a household discount in 5 different sample states. We did the same for a male with the same demographics and found that Aetna (includes Accendo), Humana, Omaha, Medico, Elips, Prosperity Life and Allstate are the most competitively priced companies.

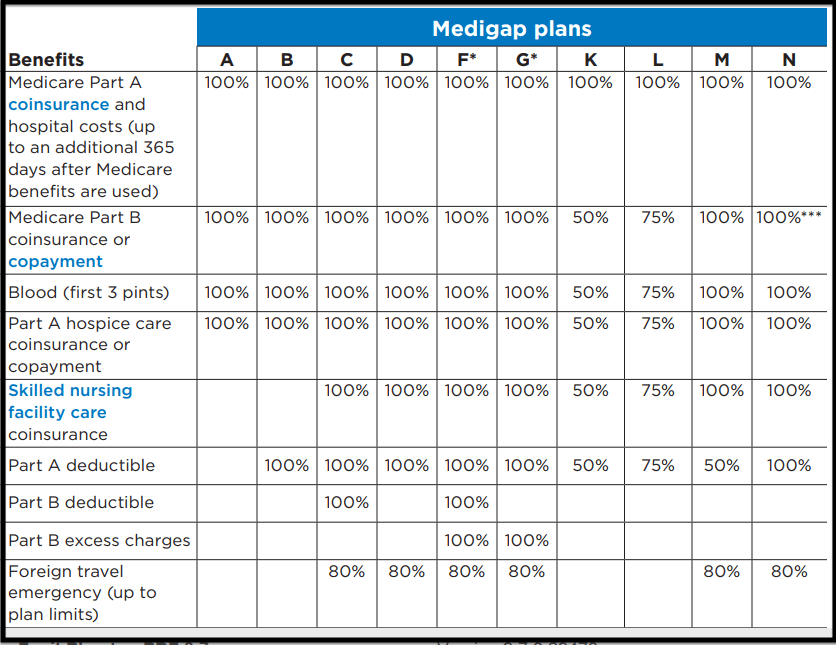

Medicare Supplement Plan G Benefits

- Part B coinsurance and copayments

- Part B excess charges

- 100% Part A coinsurance and hospital costs

- Blood (3 pints)

- Part A Hospice

- 100% Part A Skilled Nursing Facility

- Foreign Travel emergencies

**Plan G does not cover the annual Medicare Part B Deductible. Medicare changes the amount almost every year**

What Isn’t Covered by Plan G

Plan G policyholders are responsible for the amount that Medicare doesn’t cover under Part B (20% of Medicare approved charges) up to $203 in 2021. You’ll get bills for small amounts until you reach the deductible, but if you have a more costly expense right around the beginning of the year, you may have to pay the full deductible all at once. The important thing to remember is that once you have paid out the $203, you should not pay anything else for Medicare approved Part B services.

How does Plan F compare to Plan G

Medicare Supplement Plan G provides all of the same benefits that plan F provides with the exception of one benefit. If you choose to enroll in the Medicare Supplement plan G, you will be responsible to pay the standard annual Medicare part B deductible. Medicare sets the Part B deductible and usually goes up small amount each calendar year. The deductible was $198 last year and is $203 this year of 2021.

It’s not uncommon for a provider to send out bills that exceed the annual deductible partially because the Medicare system has not been updated with previous claims, or due to a common error by the provider’s office. If this happens, simply call the provider and let them know they need to re-bill the service because you already met your deductible. This is why it’s important for you to keep track of your medical bills especially at the beginning of the year.

If you already have an F plan, and are having trouble finding another company that’s has a lower premium for plan F, it’s well worth considering the Medicare Supplement Plan G instead. The plans are truly identical (other than the annual deductible) and you’re not decreasing anything significant. Keep in mind that Medicare discontinued Plan F in 2020 for anyone new.

Rate increase trends for the Medicare Plan G

Another reason to consider the Medicare Plan G instead of the Plan F, are future rate increases. Most companies are imposing a lower percentage rate increase for their G plans than the F plan. There are many reasons why the increases may be less for a G than F, but one of the biggest factors is that the insurance company is not paying 100% of the claims from day one. That $203 that Plan G policy holders pay helps to keep the claims ratio down. With the F plan, the insurance company pays all the claims.

Rates for Medicare Supplement Plan G are usually less than Plan F. The difference in the premium is typically a lot more than the Medicare Part B deductible. The older you are, the larger the spread. It’s not uncommon for someone in their 70’s to be a able to get a G plan for more than $500 less per year than an F plan. Most consumers are willing to accept a small deductible per year out of pocket to save $500 per year on premiums. The only down side to a Medicare Supplement Plan G is that you will need to pay attention to your medical bills and keep track of how much you have paid out since the beginning of the year.

Enrolling in Medicare Supplement Plan G

You can purchase a Medicare Plan G when you first become eligible to enroll in a Medicare Supplement by either turning 65 first enrolling in Medicare part B. These are open enrollment periods which allows you to choose any Medicare Supplement offered by any insurance company operating in your resident state with out answering any health questions.

The Medicare Supplement Plan G is available to anyone at anytime if you are willing to be medically underwritten. In other words you would have to answer the health questions and allow the company to investigate your medical records, prescription history and MIB (Medical Information Bureau) report. In addition you may also be required to do a telephone interview. We can help determine if you will qualify medically by talking with us for a few minutes.

If you started Medicare before January 1, 2020 you can enroll in plan F without medical underwriting. On the other hand, if it started on or after January 1, 2020, you are only eligible for Plan G.

Open Enrollment VS Guaranteed Issue

Open Enrollment

Medicare Open enrollment is the right to purchase any supplement plan offered by any company. The open enrollment runs for 6 months after the month that Medicare Part B starts. You won’t need to answer any health questions.

Guaranteed Issue

If you are not in the Medicare Supplement Open Enrollment Periods, then you’ have pass medical underwriting or qualify due to a SEP (special election period). There are other circumstances that could put you into an SEP, but these are the most common;

- You were terminated from a Medicare Advantage plan because you moved out of the service area

- The Medicare Advantage plan was discontinued

- Your Individual plan ended

- Your employer group coverage ended

If you were terminated from a Supplement or Advantage plan for not paying premiums, you will not qualify for a SEP.

Case Study on when to enroll in a Medicare Supplement Plan G

You have seven months to enroll in a Medicare Supplement after Part B begins. If you enroll at this time, you won’t need to answer any health questions. You can choose any company that offers any Medicare Supplement plan and any plan the company sells. If you don’t enroll when your first eligible, you won’t have the choices. Let’s use the following example:

Mary turned 65 in February 2016 and had group coverage through her employer. She did not want to add any extra expense for Medicare Part B until she had to. One year later, Mary started incurring high medical bills and decided to sign up for Medicare Part B to be effective July 1, 2017. Mary had 6 months from the date her Medicare Part B began to choose any Medicare Supplement with any company. Mary decided not to purchase a supplement at that time because she still had employer coverage.

Mary remained employed for the rest of the year. She decided to retire December 31, 2017 because her health continued to decline. Because Mary’s employer group coverage ended on December 31. she has to use Guaranteed Issue because her health is so poor that The only plan she could purchase was a Plan F on a guaranteed issue basis. Mary really wanted plan G, has to pay the higher price for plan F to get the coverage she needs.

Please don’t try to do this alone and miss your opportunity to get the plan you really want or need. We are there to help you all along the way. Call (614) 402-5160 to get help.