Medico Medicare Supplement Review

Fill out the Customized Quote form to get rates for a Medico Medicare Supplement or call (614) 402-5160 to speak with a live agent

Medico History and Company Information

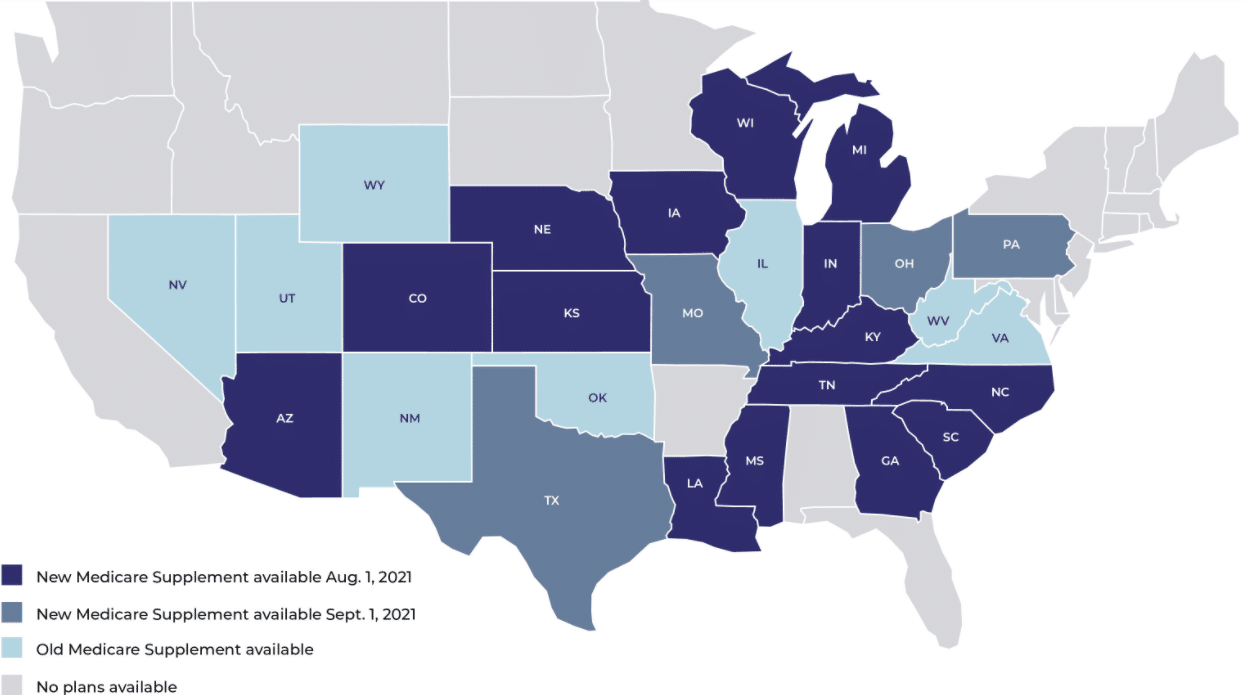

Medico recently rebranded under the name Wellabe. Wellable is made up of six insurance subsidiary companies. They started offering insurance in 1930 is now available in over 40 states nationwide. The Wellabe family of insurance products includes Medicare supplements, dental, hospital indemnity, cancer, and short-term recovery insurance. Check the chart below to see if Medico Medicare supplement is available in your state.

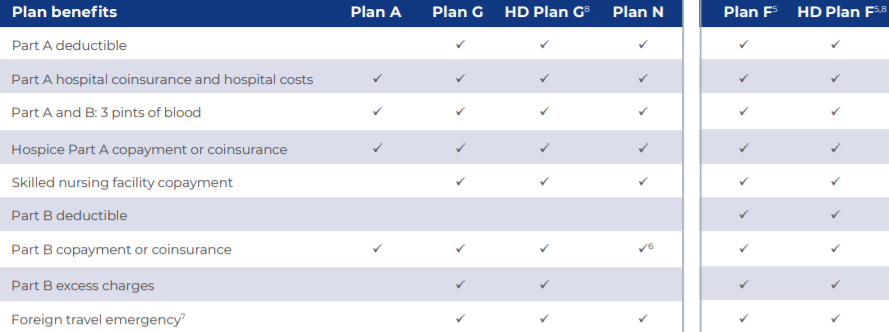

The company is rated “A” by A.M. Best, a trusted source that helps determine financial strength and stability. Medico was previously “A-“, but the recent upgrade to “A” is a clear indication that Wellabe is a solid choice for Medicare supplement (Medigap) insurance. Policies have grown to over 450,000 policies nationwide and over $2.4 billion in assets. If the plan you’re looking for isn’t offered by Medico, fill out the form and choose the plan you’re interested in. Medico offers the more popular standardized Medicare plans including A, F, G, N, High-deductible F, High-deductible G. There are over 10 different Medicare Supplement plans available but Medico chose to offer 6 of them.

Medico offers the more popular standardized Medicare plans including A, F, G, N, High-deductible F, High-deductible G. There are over 10 different Medicare Supplement plans available but Medico chose to offer 6 of them.

Medico Medicare Supplement Plans and Features

All Medico supplements include the following features:

- Medico Medicare supplements do not a include any pre-existing condition clause. Once your accepted, your Medicare approved services are covered. Some Medicare supplements don’t cover a condition that you were treated for in the last 6 months.

- As long as you pay your premiums, your policy is guaranteed renewable. The only reason your policy can be cancelled by Medico is if you don’t pay your premiums.

- You can’t be singled out for a rate increase.

- 10% household discounts are available for those who qualify. Medico offers a household discount in most state. Medico offers Medicare Supplements in about 50% of all US states. Most of the states give a 10% household discount but there are a few with 12%. The household discount may not be available unless two members of the household both enroll in a Medico supplement. The discount will only apply in certain situations and will vary by state.

- Your choice of doctors and hospitals

- 30 day free look period

Choice of Plans

PLAN A

Coverage for the most some of the largest gaps in Medicare. It doesn’t cover the Part A deductible. The Medicare Part A deductible is set by Medicare and it increases by a small amount each year. This only effects you if you are admitted to a hospital or skilled nursing facility and is $1484 for 2021 plan year. If you go to a skilled nursing facility you’ll pay a small coinsurance for days 21-100.

PLAN G

Plan G is the highest level of coverage available for Medicare beneficiaries who were eligible for Medicare on or after January 1, 2020. All of your medical coverage gaps are covered by the supplement other than the Part B deductible which is $226 in 2023.

PLAN F

Plan F is the highest level of coverage for those people who were eligible for Medicare before January 1, 2020. No deductibles, copays or coinsurance for any Medicare A and B service. No bills from physicians, labs or hospitals either. If you’re eligible for a G plan you should compare rates before purchasing another F plan. Most of the time the G plan makes more sense because the premiums are typically lower than the deductible it covers on the F plan.

PLAN N

An cost effective plan that can lower the premiums by ten to twenty percent. It’s comprehensive coverage but you may pay up to $20 for an office visit, $50 for an emergency room visit and any excess charges for Part B services. It’s not a common practice for physicians to charge excess, but in certain areas of the country it’s becoming more popular.

High Deductible Plans

HIGH DEDUCTIBLE PLAN F (HDF)

All the benefits of Plan F, but you will have a $2700 deductible for 2023. Benefits under the HDF plan are identical to the benefits for the HDG. If you were eligible for Medicare prior to January 1, 2020 you get the F plan, after that date you get the G plan.

HIGH DEDUCTIBLE PLAN G (HDG)

All the benefits of Plan G, but you will have a $2700 deductible for 2023. Medicare will always pay their portion covered by Parts A and B. For example, Medicare pays 80% of the bill for a doctors visit, testing and treatments. There’s 20% left over that you’re responsible to pay. Anything that you pay out of pocket to cover the 20% goes toward meeting the deductible. This includes the Medicare Part B deductible each year. This is also true for hospital expenses and Part A deductible that also goes toward meeting your deductible.

Enrollment Periods

Medicare Open Enrollment

If you want to enroll in a Medico Medicare Supplement you can choose either plan A, G, HDG, F, HDF or N. You won’t need to answer any health questions. If you’ve used tobacco in the last 12 months, and you’re within 7 months of your Medicare Part B effective date you may even get the non-tobacco rate. Tobacco vs non tobacco rates will depend on the state you live in.

Guaranteed Issue Periods

There are many situations that you may qualify for guaranteed issue. If you meet the guidelines, you’re accepted without answering any health questions. All of the Medico’s Medicare supplements are available under Guaranteed Issue EXCEPT plan N. Note: If you’re healthy you can still apply for plan N. You can get coverage for the N plan if you can pass medical underwriting.

Here are a few examples of guaranteed issue situations:

- Your employer group plan is ending

- You move out of a Medicare Advantage plan service area

- The Medicare supplement company you currently have declares bankruptcy or insolvency

- Medicaid drops your coverage

- You’re in a Medicare Advantage trial period. A trial period occurs if you are in the first 12 months of ever trying a Medicare Advantage Plan

Medically Underwritten Policies

You can apply for a Medicare Supplement with Medico any time of the year and you don’t need a special enrollment period. The agent will go over your health history and medications to help determine if you’ll pass underwriting. Medico makes the final determination and is the only one who can approve a policy. If you want to apply for a Medico Medicare Supplement, then call us directly or fill out the customized quote form.