Prosperity Life Final Expense

Fill out the form on the left to get instant quotes or apply for a Prosperity Life New Vista plan

Prosperity Life Insurance Group, LLC first incorporated in 2009 has earned an A- with A.M. Best, the 4th highest rating out of 15 levels. Prosperity Life Group represents several insurance companies with different products including Medicare Supplements. The companies included under the Prosperity Life umbrella are S.USA Life Insurance, SBLI USA, Shenandoah and Prosperity.

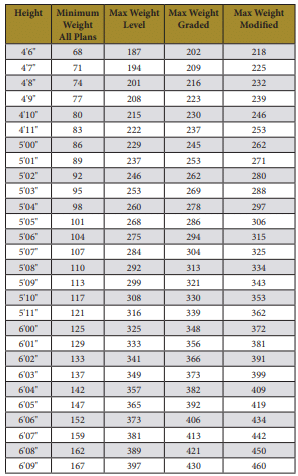

The branch that markets the final expense life insurance is Prosperity and the plan is called New Vista. This is a competitively priced product with three levels of benefits which is determined by your health. The healthier you are, the better the benefit at a lower price. The ability to pay your premiums with a debit or credit card and their simple phone application are great reasons to give this company a good look. They’ve made it simple, affordable and easy to qualify for.

This is a whole life policy, so the premiums will never go up, and the coverage will never go down. You can’t outlive the policy either. It will pay off no matter how old you are when you die. The coverage is available to adults from age 50 to 80 years old (Golden Promise from 50-75 in New York) . It also includes an accelerated death benefit for up to 50% of the death benefit if your diagnosed with a terminal illness. An Accidental death benefit rider is available for a small extra premium for ages 50-75.

Prosperity Life Final Expense Plans

Level – This policy pays the fu

Graded – The death benefit is paid out based on a percent of the death benefit purchased. It pays 30% in the first year, 70% in the second and 100% thereafter. If you purchased a $10,000 policy and died 8 months later, your beneficiary would get $3,000. If you passed away in the 18th month of the policy, it would pay 70%, or $7,000. Once you have paid for the policy for 24 months, it would pay the full $10,000 benefit.

Modified– If you can’t qualify for the first 2 levels, you may be able to at least get the modified death benefit. This pays your beneficiary the amount of premiums you paid in plus 10% interest, common for most modified polices. If death occurs in the second year, it pays back all the premiums you paid plus an additional 131% more. This modified benefit is far superior to most other modified policies.

Coverage for Diabetics

Its not easy to find life insurance with an immediate level death benefit, but Prosperity Life is one of the few companies who is willing to do it. No worries if you were diagnosed with diabetes at a young age, or even if you use any amount of insulin. If you have any complications as a result of diabetes like diabetic neuropathy, went into insulin shock or a diabetic coma, you can still get covered with a Modified death benefit.

Liver Conditions and Kidney Disease

If you have chronic hepatitis, Cirrhosis stage A or B or on kidney dialysis, you have probably been unable to find any type of life insurance policy that pays more than just a return of premiums plus some interest for the first 2 years. Prosperity Life will consider you for their Graded benefit as long as you’re not waiting for a transplant. If you have one of these conditions, please give us a call at (624)402-5160 to find out which level you qualify for. Please remember you’ll have to pass some other heath questions but it’s very possible you’ll qualify.

Prosperity considers many other conditions for their Graded Product instead of only a Modified benefit as with most other companies. These condition include Parkinson’s, COPD, Bi-Polar Disorder or Schizophrenia and hospitalizations in the last two years for mental or nervous disorders.

How to Apply

Fill out the Final Expense quote form and click on “Get Quotes Now”. Find Prosperity Life on the list and click “Get Application”. Once we get your request, we’ll call you and go over the qualifying questions. If you pass and want the policy, there’s a few different ways to complete the application, but we recommend using the voice signature method

Applying is quick and easy. Once the agent has recorded all the information and emailed you all of the disclosures, you give your voice signature to apply over the phone on a 3 way conference call. When the call is complete, you’ll know if your approved and which plan you qualify for immediately. You’ll be able to choose the date you want to pay your premiums either by credit/debit card or through your checking or savings account no more than 30 days into the future.

If you are purchasing the policy to replace a policy you currently have, the entire process will need to be completed on paper and the home office will call you to complete the interview. It doesn’t change the product you’ll qualify for or change the rates, it will just take a few days longer to process.

Why Choose Prosperity Life for Final Expense Insurance?

This company is offering one of the best final expense plans at extremely competitive rates. Their high level of customer service is unparalleled and they offer other products as well including one of the most competitive Medicare Supplements. Their willingness to accept debit and credit card is a rarity, and the application process is user friendly. It’s difficult to get any level of an A rating with A.M. Best, and they’ve earned it.

Prosperity Life’s voice signature is available in the following states. If you don’t see your resident state listed, please give us a call at (614) 402-5160 and use a paper application for you to apply.

AK,AL, AR, AZ, CO, FL, GA, ID, IL, IN, KS, KY, LA,MA, MD, Ml, MN, MO, MS, NC, NE, NJ, NM, NV,OH, OK, OR, RI, SC, TN, TX, UT, VA, VT, WA, WI,WV, WY