Royal Neighbors Final Expense Life Insurance Review

Fill out the form on the left or call now to see if you qualify for Royal Neighbors in just a few minutes!

Royal Neighbors is a Fraternal Benefit society originally founded in 1895 to provide life insurance to women. At that time women could not vote, could not own property or life insurance. Most companies only offered coverage to men at the same rate as women and would not insure children. They were one of the first female led companies in America and one of the first to recognize that women live longer than men.

The founding members actually arose from wives of husbands that belonged to Modern Woodmen of America, another fraternal organization. There were eight wives that began this social organization complete with a constitution, articles of incorporation and ritual. The name Royal Neighbors was derived from Proverbs 27:10 that “For better is a neighbor that is near than a brother that is far.”

In 1894 the social organization decided to incorporate in the state of Illinois (the state that had the most sensible insurance laws) and then became a full fledged fraternal benefit society in 1895. The home office was originally in Peoria and has since moved to Rock Island.

Royal Neighbors offers Final Expense, Term,Whole Life,Universal Life and Annuities insurance for members and their families.

Why you should consider Royal Neighbors Final Expense Insurance

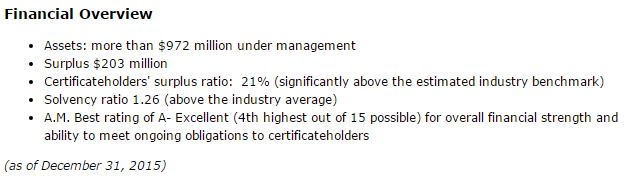

The Royal Neighbors, an A.M. Best A- rated company, is one of the best final expense burial insurance plans on the market and they don’t care about height and weight. They offer two, an has different levels of coverage depending on your health. The first set of questions may be slightly tougher to pass than some other companies, but if you do it’s a great plan no matter what level you get.

The best level is called Simplified Issue Whole Life. You must pass all the health questions to be approved. The coverage is offered to applicants ages 50-85 and the the amount available is $3,000 to $25,000.

The other level is the Graded Death Benefit. Most companies only offer a return of premiums paid plus a small amount of interest around 10% if the insured dies in the first 2 years of the policy. Royal Neighbors is better in both years. If the person dies in the first year, the death benefit is 30% of the face amount and in the second year it’s 70%. The first year payout is the the best we can find in the industry and the second year too.

The best feature of the this company is there are no height and weight charts to pass. It just does not matter how much you weigh. Nearly all companies today use the body mass index to determine if a person is healthy enough to pass their guidelines. The only type of insurance that usually does not consider this are the Guaranteed Issue “No Health Questions Asked” policies that will cost more and give back less. Those policies should not be used unless you cannot pass anything else.

TIA’s are not considered the same classification as a stroke with the Royal Neighbors final expense policy. As long as you can pass the other qualifications, a TIA (sometimes referred to as a mini stroke) will not knock you out of the Simplified Issue immediate death benefit or the Graded Benefit. They don’t even care it happened last week!!!

Conditions NOT accepted for consideration

- Currently in a hospital or any other facility or in Hospice

- Current use of oxygen

- HIV/AID/ARC

- Confined to a bed or wheelchair

- Ever had congestive heart failure

- Ever had an organ transplant

- Ever been in insulin shock, a diabetic coma or used insulin before age 30

- Diagnosed with Alzheimer’s, dementia or diminished mental capacity

- In the last 18 months had chest pain (angina), a stroke, aneurysm, cardiomyopathy, any circulatory surgery, heart surgery of any kind, heart failure or a heart attack, diagnosed with a terminal illness expected to result in death in the next 12 months, advised to have drug or alcohol treatment including counseling or had any test for which the results have not yet been received.

- In the last 24 months diagnosed with or treated (including taking medication) for cancer other than basil or squamous cell skin cancer, Leukemia, kidney disease including having dialysis, systemic lupus or liver disease including cirrhosis.

If any of the above are true for you, please talk with our independent agents to look at other policy options

If you can say that nothing in the above category fits the description of your health, then you know you can at least get a policy that will pay 30% in the first year, and 70% in the second. We cannot express enough how big that is! No person actually thinks they are going to die in 6 or 18 months unless they have been told by a physician they are terminal. It’s so silly to predict and bank on when a person will die. Remember to always “Protect Your Future Today, & Expect the Unexpected.”

Pass these next parameters, and you’ll likely qualify for the level, immediate death benefit. You must not have been treated (including taking medication) or diagnosed …in the last 24 months

- COPD, Tuberculosis or Emphysema

- Multiple Sclerosis, ALS, Epilepsy, Parkinson’s or any other neuromuscular disease

- Pacemaker implant, heart valve replacement, angioplasty, stent, bypass or any other heart or circulatory surgery

- Cardiomyopathy, heart attack, stroke or angina

Even if the Royal Neighbors final expense plan is a few dollars more, or if you have to accept a lower death benefit, doesn’t it make sense to buy a policy that will at least pay your beneficiary a percent of the total death benefit than just returning premiums and a little interest? Sometimes price is NOT the best way to shop for a plan. If you cannot qualify for a full and immediate death benefit then price should be secondary, and the amount of death benefit should be your primary concern.

If you purchase the amount you need to pay for the essential final needs, then you can always add another policy at a cheaper price that has the two to three year wait, meaning a policy that only pays premiums you put in and about 10% interest.

I want to remind our readers that we do not believe in using term insurance as a way to cover final expenses or burial expenses. Term insurance in small amounts usually goes up in price ever 5 years, ends a certain age, or becomes too expensive for most people to continue.

Talk with our independent agents to evaluate your specific conditions and goals. We’ll look at the companies that should approve you, and then figure out who will give you the Best Quote for the highest level of coverage with a trusted and financially solid company.