Best Life Insurance in your 80’s

Find the best Life Insurance in your 80’s. Just fill out the form and click!

I can’t tell you how many people think that they can’t get life insurance if they are over the age 80 or older. Yes it may be a little more challenging than finding a policy for a 60 year old, but it’s actually very easy to get the best final expense burial insurance for age 80 and over. Some companies will give you a policy even if you are as old as 89, and once you have you can keep it for the rest of your life.

Get low cost Final Expense Life Insurance in your 80’s

5 STEPS TO FINDING LIFE INSURANCE IF YOU ARE 80 YEARS OLD AND OLDER

1. Make a list of your medications. When you are taking an inventory of your medications, be sure to include the strength of the pill

and the number of times you take it per day. You will also need to know the reason you are taking the medication. Many drugs have multiple health conditions it can be use for and the insurance company may accept it’s use for one condition but not another.

Taking a pill for your heart is not specific enough. You will need to know the exact heart conditions like Atrial Fibrillation or Coronary Artery Disease. If you are not sure about the exact reason, call your doctor’s office and ask. You really don’t need to talk with the doctor, but they will probably have you talk with a nurse.

2. Know your medical history of hospitalizations and treatments for the last 3 years. Be sure to include any outpatient or inpatient procedures including minor procedures. Some companies will want to know how many days you were hospitalized and how many different times your were admitted. Understand that an emergency room visit is not considered hospitalization! If they don’t admit you and keep you at least 24 hours, it was just an ER visit. The treatment, if any that you got in the ER does count.

Treatments both in a doctors office and an at an outpatient facility can include many things like chemotherapy or radiation therapy, breathing treatments, dialysis and much more. It’s important to be as detailed as possible.

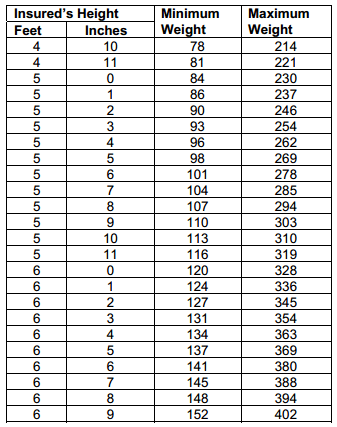

3. Weigh and measure yourself. Almost all companies have body mass or height and weight charts. Every company has different limitations. Body mass effects many different health conditions. According to webmd.com the following are basic guidelines but let our independent agent check you weight with each company. This is just so you have an idea.

Underweight: Your BMI is less than 18.5

Healthy weight: Your BMI is 18.5 to 24.9

Over weight: Your BMI is 25 to 29.9

Obese: Your BMI is 30 or higher

If you don’t know your BMI then below is a sample height and weight chart that a final expense company could use. If you don’t fit within these guidelines, don’t worry. You can get a final expense insurance policy that does not have any height and weight requirements. We just need to dig a little deeper.

4. Determine your monthly budget. It’s easy to say “I want $20,000”, but you have to be realistic, especially if you are 80 years old and over. First of all everyone has a budget no matter how much money you have. Think of it this way. No matter what happens; Christmas, birthdays or graduations, this is no different that paying a utillity bill. You have to be comfortable with a specific amount that you know you have to pay month after month, and year after year until you die. It’s just like your electric bill, which is a must pay and not an option. The point I’m trying to make is if you can’t afford to start it today because Christmas is around the corner, then you should not spend that much and need to lower your expectations.

There are no additional fees for the first month to get started, so if you have already spent your extra money for this month, then plan on having the policy start next month. You don’t need to pay a deposit or two months premium up front like years ago. In fact you can schedule your first payment to be deducted usually up to 30 days in the future.

5. Take the last step and apply. Now your prepared to talk with an independent agent. You will have all the information ready to determine what type of death benefit and how much you’ll have to pay each month. It doesn’t cost anything to apply except a few minutes of your time. You do want to make sure that you are completely honest with the agent so we don’t put you with a company that would decline you. If you have been declined, it can limit the other companies we could look at as an alternative.

WHAT HAPPENS DURING THE APPLICATION PROCESS?

- After you have completed the application with the agent over the phone, you will have to sign your application which will include some additional authorizations. You must give your authorization for the insurance company to order certain reports.

- Most companies use a combination of a prescription history, MIB (Medical Information Bureau) report, medical records (although 99% won’t) and even a Motor Vehicle report. Don’t let this scare you. The companies expect to find prescriptions and medical treatment. They just want to make sure that what you said on the application matches what they find in the reports.

- The majority of insurers will want to do a telephone interview. Sometime the agent can help facilitate the interview when you do the application. Others prefer to do it after the get the application in the home office and have the reports.

HOW LONG DOES IT TAKE TO GET COVERED?

You should have an approval in about two to seven days depending on the company. These polices are simplified issue and are designed to be evaluated quickly. The companies do not want to spend a lot of money paying to get doctors records or ordering medical exams. They are designed for the senior market or for people who have health conditions.

We’ll make sure this is a painless, simple and quick process to find you the Best Quote for your life insurance!