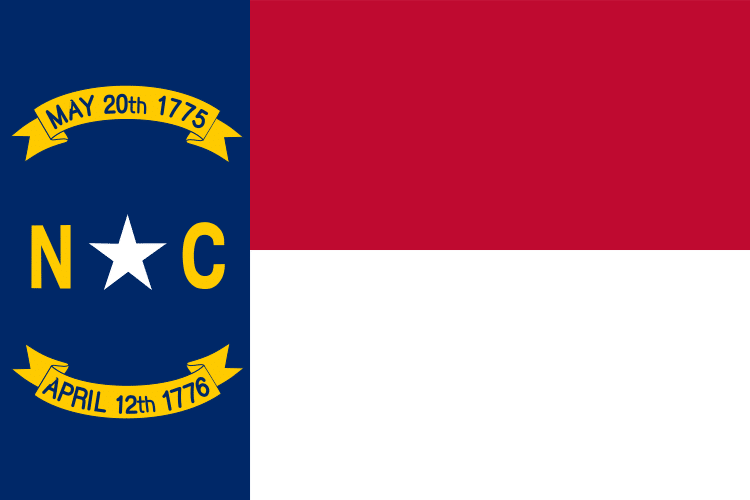

Medicare Supplements in North Carolina

SAMPLE COMPANIES

Allstate

One of the nation’s most recognized insurance companies for Auto, Home Owners and other Property and Casualty insurance is in the Medicare Supplement market now. The purchased National General’s Accident and Health lines and were rebranded. If you’re able to pay your premiums one time per year you’ll get an additional 10% discount plus a household discount if you qualify. This makes them one of the lowest priced Medicare Supplements on the market

Transamerica

The division that administers and markets the Medicare Supplements is Transamerica Premier Life Insurance Company is the division that markets and sells the Medicare Supplement. They’ve carried an A+ rating by A.M. Best, the organization used to measure an insurance companies ability to pay it’s claims, for many years. They are most well know for their competitively priced and forward thinking Life Insurance policies. You’ll probably recognize their pyramid shaped sky scraper in San Francisco. Their Medicare Supplement is straight forward priced and is the same whether you’re enrolling with a spouse or not and they do charge a $25 application fee.

Cigna

This company should definitely be familiar to you. They’ve been in the under 65 health insurance market for years and you may have had them through an employer in the past. Cigna has a subsidiary company called American Retirement Life Insurance Company that offers Medicare supplements too. They market their products under different divisions depending on what state you live in. . All the companies under Cigna’s umbrella are administered from the same place. The Cigna family of companies has an A rating from A.M. Best and is always trying to offer competitively priced Medicare Supplements. If you are enrolling with a spouse, Cigna will reduce your premium.

Mutual of Omaha Companies

The Mutual of Omaha family of companies are A+ rated with A.M. Best for many years. Omaha companies gives you a discount on your premiums just because you live with another adult in the house. You don’t have to be married and it could be anyone as long as the are at lease age 18 and have lived in the household for the past year and there’s no application of policy fee to pay.

Aetna

This is another company that has different subsidiary companies in different states that offer Medicare Supplements. They’re competitively priced but they’re about 20-30% higher that some of the smaller, less recognizable organizations. You can only get the d 7% discount if you have a spouse that either already has a supplement with one of the Aetna family companies. The Aetna family includes Aetna Health and Life, American Continental and Continental Life . They will charge $20 application fee per person.

United American

They’ve been around longer than any other company for Medicare Supplements. Their flagship product, High Deductible F is a solid choice that can save thousands of dollars in premiums will keeping you covered for catastrophic medical events. This company has over 500,000 policies in force all over the United States. United American is an A+ rated company by A.M. Best. There is no household or married couple discount and there is no application fee.

GPM

With a solid rating of A+ by A.M. Best, and a solid history of over 8 years in the supplement market, Government Personnel Management is a strong competitor in the supplement market. The company began in the 1930’s serving our military and family members. The company then expanded to serve federal employees, individual customers, and senior citizens. It’s probably a company you’ve never heard of, but they’re worth taking a look at. Mutual of Omaha, a long time leader in the Medicare supplement market, actually administers the plan and services it’s policy holders. There’s a $25 application fee and the only way to get a 7% discount is if another person that you live with also has their supplement.

Bankers Fidelity

Bankers Fidelity is not related to Bankers Life or Liberty Bankers. They’re completely unrelated and easily mistaken for each other. Bankers Fidelity has offered Medicare Supplements for over 30 years and are one of the very few that will accept certain medical conditions that most other companies will decline. They do this by rating their applicants as either Preferred or Standard rates. We’ve been successful getting applicants approved with them that were declined by another company. It’s a go to company if you have a Medicare supplement now and your trying to lower your rates.

Once you decide which plan will work for you, you can shop around for North Carolina insurance companies. These standardized plans will offer exactly the same essential medical coverage if you buy an Aetna, Omaha, New Era, or Thrivent, Medicare supplement or from any other company. To make the best choice, you can compare each company’s premiums, financial strength, and history.

Companies may also offer household discounts and membership perks that could help you save money. The rules for household discounts vary, but most insurers offer discounts of five to seven percent if another adult in the home also has insurance with the same company. Some membership discounts could include networks that can help you save money on health-related services that aren’t covered by Medicare, such as general vision and dental care.

North Carolina uses the same standard Medicare supplement plans that 46 other states use. Your first task should be to narrow down the Medigap supplement plan that will offer you the best balance of coverage and price. While you can choose from several plans, the majority of people find that one of these three plans offers them a good solution:

- Plan F: In the past, more people chose Plan F than any of the other supplements. This supplement will provide you with every benefit that Medicare allows a supplement to provide. This includes urgent care overseas and coverage for excess charges.

- High-deductible version of Plan F: With this plan, you must pay an annual deductible before your insurance will start to help you pay your bills. Once you meet the deductible each year, the plan will work just like Plan F.

- Plan G: The only difference between Plan F and G is that Plan G won’t pay for the yearly Part B deductible. Many supplement buyers find that they still benefit from the lower premiums most companies offer them for Plan G.

- Plan N: This cheaper Medigap plan requires Medicare recipients to share some of the costs in the form of modest copays for some ER and doctor visits. It also won’t pay excess charges, or bills that are higher than Medicare-allowed amounts.

North Carolina Guaranteed Enrollment for Medigap otherwise known a Medicare Supplements

You are always free to apply for Medigap plans, but some national and state laws govern when you get a Guaranteed Enrollment period. During these periods, insurance companies can’t deny your coverage because of pre-existing medical conditions. If you’re relatively healthy, you should get accepted even if you don’t have a Guaranteed Enrollment Period. Still, you should never cancel any existing health insurance until you’re certain that you have a new policy issued.

While 82 percent of North Carolina beneficiaries qualify for Medicare because they have already turned 65, the other 18 percent haven’t yet turned 65 and only qualify for Medicare benefits because of a disability. Guaranteed Enrollment Periods differ for people who are over 65 than for younger recipients.

According to the NC Department of Insurance, these are the Guaranteed Enrollment rules for these two groups of Medicare recipients:

- Over 65: Newly enrolled Medicare recipients with Part A and B can enroll in any Medicare supplement plan in the state without a waiting period or health underwriting. This period lasts for six months from the date of Medicare enrollment. In addition, beneficiaries may get an additional 68-day period to apply without answering medical questions if other health coverage terminated through no fault of the beneficiary.

- Under 65: Insurers have to accept young, disabled North Carolina Medicare beneficiaries for Plan A, C, and F. If the applicant doesn’t have credible coverage, the insurers may impose a six-month waiting period for pre-existing conditions. That makes Medicare Advantage more attractive to many of these Medicare recipients because they won’t have a waiting period. Once disabled people turn 65, they qualify for the same Guaranteed Enrollment Period as everybody else does.

Along with your Medicare supplement, you’ll also need to enroll in Medicare Part D to help you pay for prescriptions. You might buy Plan D from the company that you purchased your North Carolina Medicare supplement from, but that’s not a requirement. Being able to shop separately for your medical coverage and prescription coverage allows you to make the best choice for both of these plans.