Best Final Expense Burial Insurance with Congestive Heart Failure

Congestive Heart Failure, otherwise known as CHF affects millions of Americans. According to WebMD.com, it’s is the leading causes of hospitalizations for people over the age of 65. Nearly 6 million people in the US alone have been treated for CHF and trying to get life insurance after that diagnosis can be challenging, but not impossible. If you’ve been turn down for coverage, you may still be insurable, you just have to apply with the right company.

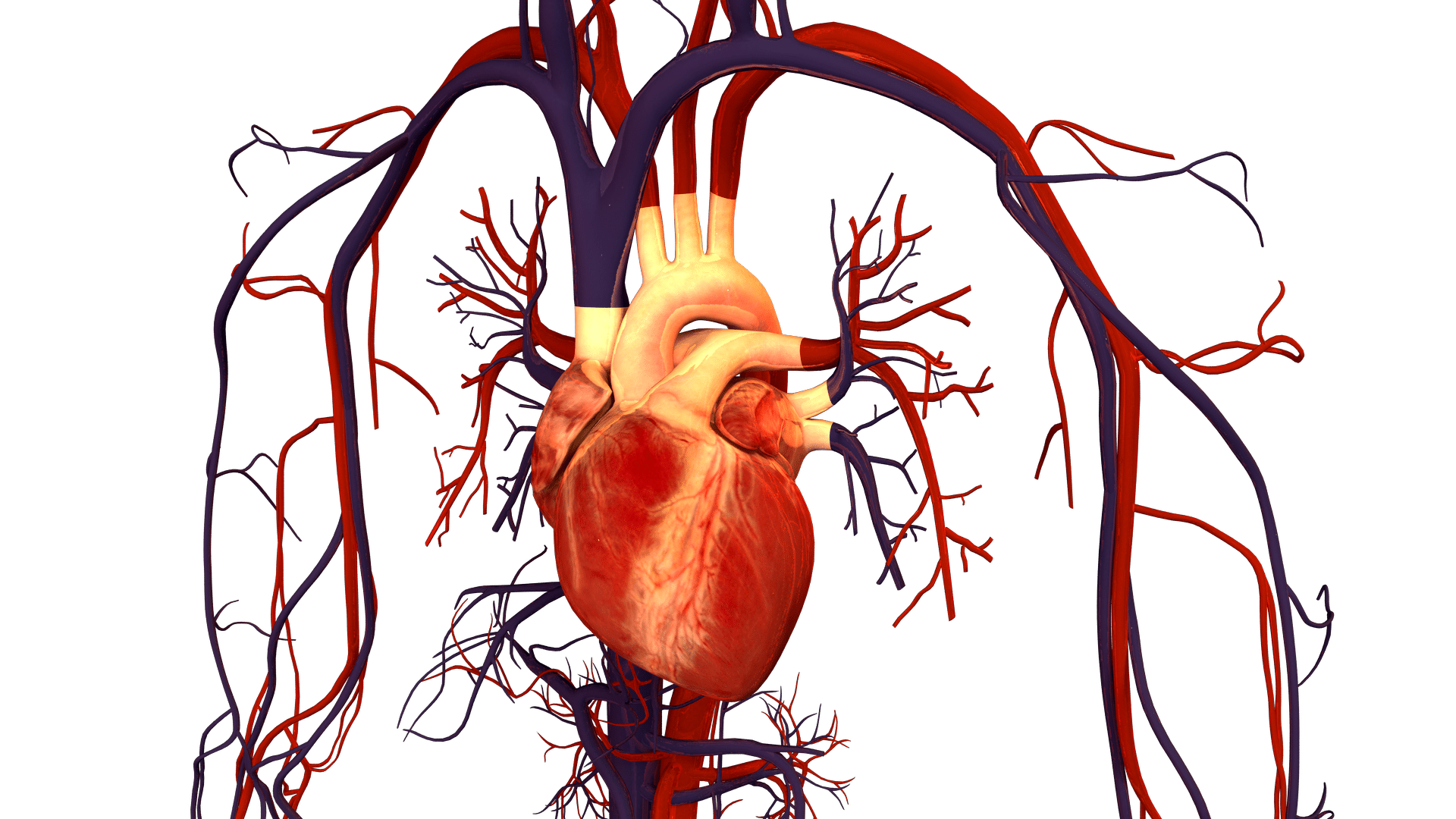

CHF doesn’t mean the heart goes into complete failure, it just means it can’t pump at full capacity. When the heart muscles weaken, it can’t pump the blood and oxygen like it should. The result is fluid retention that many time can be seen with the naked eye. When the body retains fluid you can sometimes see it in the lower legs, ankles and feet, but you can’t see it surrounding the heart. The most common way to get rid of the excess water that the body is holding, is with the use of a diuretic. Patients with CHF can be prescribed a diuretic as a maintenance medication that is taken on a regular basis to prevent the fluid from being retained.

You should know that Final Expense means the exact same thing as Burial Insurance or Funeral Insurance. These are all names for smaller amounts of life insurance typically from $5,000 to $25,000 policies. The death benefit will be paid to who every you name as your beneficiary. Most people buy this type of insurance to pay for their funerals, pay off debt, or leave money to their family.

Can You Qualify for Life Insurance With Congestive Heart Failure?

Even though most companies would consider a pill that’s taken daily a “maintenance medication”, it’s not unusual for the use of a water pill to be classified as current treatment instead. Because a diuretic taken on a routine basis continuously removes the water that builds up in the body and around the heart, it’s usually considered a treatment. Call (614) 402-5260 to go over your specific circumstances and diagnosis of CHF and we’ll be able to recommend the company that would accept you for the best level of coverage at the lowest premium.

There are only a few circumstances that someone with Congestive Heart Failure would be completely uninsurable, other than for a guaranteed acceptance graded policy.

- The applicant is over the age of 89

- Has any condition listed below

- Diagnosed with a terminal illness and death is expected in the next 12 months.

- Been advised in the last 5 years by a medical professional to have a diagnostic test or surgery that requires anesthesia and not yet completed it.

- Currently residing in a nursing facility including assisted living, hospitalized, institutionalized, receiving hospice care or waiting for an organ transplant.

- Received kidney dialysis in the last 12 months.

Any person with any condition, even those who have a Power of Attorney, can purchase a final expense policy as long as they can answer the above questions with a NO. Understand that the rates are based on age and morbidity. The older you are, the higher the premiums. If you waited to buy life insurance for whatever the reason, the time to do it is now. Once a person is over the age of 89, there is nothing available. Actually after the age of 80 is when it really gets tough and there are only 2 companies left that offer Guaranteed Acceptance with no health questions from ages 81-85.

If you are under age 86 and have Congestive Heart Failure, there a lot more options. Even more if you are under age 80. You see the trend now right? Not only are the premiums less the younger you are, there are more companies that offer coverage too, which means they are competing for your business! So younger means lower premiums and many times a better policy!

Best Modified Life Insurance Policies With Congestive Heart Failure

CIGNA

Issue ages 50-85 from $2,000 to $25,000. If you’ve been stable for the last 2 years meaning: treated with the same medication for Congestive Heart Failure with no change in the dosage, no procedures, no treatments and n0 hospitalizations or ER visits for CHF, then Cigna would consider the IMMEDIATE Death Benefit with no waiting periods. If you have had treatment in the last 2 years that’s OK too and you would qualify for their Graded Benefit.

The Graded Benefit pays back 100% of premiums paid plus 10% interest during years 1 and 2 and 100% of the death benefit starting in year 3. Accidental death is payable at 100% immediately. Cigna has two different final expenses policies: one that comes in combination with their Medicare Supplement that starts at age 65 and another you can purchase separately that comes with a 5% discount on the younger spouse when a spouse applies at the same time. The rates are the same and the underwriting is more difficult on the combination, so don’t combine them. Apply for separate policies.

Congestive Heart Failure in combination with any of the following could cause the rate to be slightly higher for people with the followingDiabetes including Type I or II using oral medications, injectables or insulin.

Tobacco use in the last 12 months

Your weight in proportion to your height

AETNA

Issue ages ages 45-80 / Death Benefits from $3,000 to $35,000- 2 year graded policy that pays 40% if death occurs in year one, 75% if death occurs in year 2 and 100% for years 3+. Accidental death is payable at 100% day one.

Best Guaranteed Acceptance Life Insurance With Congestive Heart Failure

AIG

Ages 50 to 85 / Death Benefit from $5,000 to $25,000 Guaranteed Issue. No health questions. Graded Benefit in years 1 and 2 that pays your beneficiary 110% of the premiums you paid in. It also pays the full death benefit beginning the third year and after.

GERBER

Ages 50 to 80 / Death Benefit from $5,000 to $25,000 Guaranteed Issue. No health questions. Graded Benefit for the first two years that pays 10% interest plus the return of all premiums paid. Available in all states except Montana. You cannot purchase this policy to replace an existing policy.

GREAT WESTERN

Ages 40 to 80 / Death Benefit from $1,000 to $40,000 Guaranteed Issue with no underwriting. Graded Benefit for years one and two that pays 110% of the paid in premiums to the beneficiary. This is one of the few companies that will accept a Power of Attorney to sign as the insured, owner or payor.