Best Medicare Supplements

Fill out the form or call (614) 402-5160 to compare rates for the Best Medicare Supplements

MEDICARE SUPPLEMENTS PLANS AND COMPANIES

A Medicare Supplement or “Medigap” policy is private insurance that pays the Medicare deductibles, copays and coinsurance for Medicare covered services. Medicare Part C, more commonly known as Medicare Advantage, is not the same as a Medicare Supplement.

Medicare began on June 30, 1965. It was Harry Truman’s original concept, but it was Linden Johnson who signed it into law. The first Medicare Supplement (Medigap) plans were offered in 1980 to fill the gaps in coverage that Medicare didn’t cover. Since that time, plans have been added, removed and modified.

How to Choose the Best Medicare Supplement Company

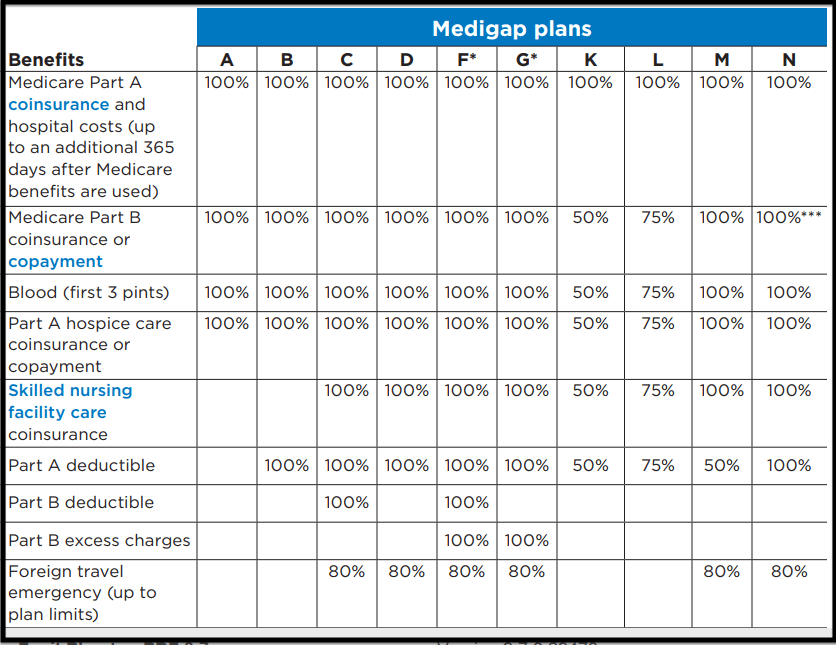

Decide which Medigap plan design is best for you from the chart below. The most common plans are G, F, and N. Expect higher rates for plan F because it pays the most, and lower premiums for Plans G and N.

- Avoid companies with multiple and substantial rate increases for two consecutive years. Just because a company hasn’t had an increase recently isn’t a guarantee it won’t go up. It also isn’t an indicator that “it’s due” for one. If you have an attained rate policy, your rates will likely increase two to three percent every year which is normal. Your rates will likely increase in the future based on the claims experience of the company too. The average claims rate increase is about three to five percent.

- Steer clear of companies that offer low rates and high loss ratios. A “Loss Ratio” is a great indicator on how well they have estimated the amount of premium they should have charged. Loss ratios reflect the amount of claims they paid vs premiums received.

- Most companies offer a “household”, “companion”, or “co-habitation” discount. The discounts typically range from 5% up to 12%. Discounts vary from company to company and state to state. Some companies allow the discount just for living with another adult, while others require another the spouse to join as well.

- Use a company that has at least two to three years under their belt in the Medicare Supplement market.

- Check out the extra benefits like a fitness membership. If you don’t have to pay a gym membership that costs you $600 per year, and can get it at no cost, that translates into saving you another $50.00 per month. If the premium was going to be $150.00 per month for plan F, really all you’re only paying $100 because you’re saving $50.00 on the gym membership.

- Decide if you prefer a highly recognizable company, or possibly a smaller company you’ve never heard of. There are a lot of companies that don’t spend the money on advertising but don’t discount them as an option. Sometimes smaller is better and you can actually talk with a person that can resolve a problem. It’ a personal preference.

- Shop around when your policy is a few years old, or if your rates increased over 20%.

What You Need to Know Before You Buy

Medicare Supplements are Standardized

In 1982 Medicare decided to “Standardize” Medicare Supplement plans for all companies and states other than Minnesota, Massachusetts and Wisconsin. This took the confusion out of comparing plans company to company and simplified the process of purchasing the best Medicare Supplement for each individual. Standardization “leveled the playing field” and helps seniors make a more informed decision and understand what they are signing up for.

When you look at a plan G with one company, you can be assured that the benefits are exactly the same when you compare the cost of a G plan with another company. The biggest difference between one company and another is the cost, but we can help you understand other factors like past rate increases, AM Best ratings and other company trends.

Several Medicare standardized plans have been eliminated for new buyers over the years and replaced with others. After the original plans were designed in 1982, plans have been eliminated for new buyers and others were added. The same just occurred again in January of 2020.

The plans you can choose from now are A, B,C, F, G, High Deductible F (HDF) or High Deductible (HDG), K, L, M and N. Not all companies offer all the plans. Each company can choose which plans they want to offer based on the requirements of that state. Medicare Supplements companies will have different rates and may offer different standardized plans designs depending on your zip code, gender, age, available household discounts and tobacco use.

Plan C, F and High Deductible F (HDF) are only available for new buyers if you had Medicare part B and/or part A before January 2020. Medicare beneficiaries that have a C or F or HDF plan now, can keep their coverage. If you want to change companies, you can change and purchase the C, F or HDF plan with a different company as long as they offer that plan.

Current Medicare Supplements DO NOT cover prescription medications. You should get a Medicare Part D plan separately. In general, you need do this when you first become eligible for Medicare, during one of Medicare’s annual election periods, or when you have a life event that qualifies for a Special Election Period (SEP). These plans are sold by companies who have a contract with Medicare to provide RX benefits, and are an additional cost over and above Medicare Part B and your Medicare Supplement premiums.

How are Medicare Supplements are Priced?

Companies can offer Medicare Supplement plans based on different ways to calculate rates. The majority of companies “Attained Age”. It’s really not much of a choice for the consumer. Depending on where you live usually determines what system most companies offer.

ALL Medicare Supplements can increase to an unknown amount no matter which pricing system the company uses. If they need to collect more premiums due to inflation, high medical claims or an unforeseen economic impact, your rates are subject to increase. Your rates will never go up due to your own personal medical claims, but they will increase based on everyone with the same plan and company in a specific area.

- Attained Age – Rates are based on your age when you purchase the policy. Your rates will increase by a predetermined amount every year on your annual renewal date. Most of the time rates remain the same for ages 65, 66, and 67. An average annual age rate increase is about 2% to 4%. Your rates will increase each year according to the schedule.

- Community Rated – Rates are the same for all ages in the same geographic are like the same zip code or state. Tobacco users and Male vs Female can still have an impact on the rates. Very few companies offer this type of rate.

- Issue Age – The rate will remain the same based on the age when it was first issued. This means that you can’t be charged more because you become a year older. It DOES NOT MEAN your rates will stay the same. Your rates will still go up when there is an adjustment due to inflation or high claims. There are only a handful of companies use this rating system and it doesn’t protect you from increases as most people assume.

Who Can Enroll in a Medicare Supplement?

Medicare Supplements are available in all 50 states. You must have both part Medicare Part A and Medicare Part B. Part A is awarded to you at no additional cost if you paid into Medicare. Most automatically get part A by paying taxes through your personal earnings or your spouse’s earned income over the years. In order to have Medicare Part B, you need to pay the monthly Medicare Part B premiums. The Medicare Part B premium is determined by Medicare each year and may cost you more if your prior year earnings were over the standard limit. Contact Social Security to determine how much you will pay for Medicare part B.

You can buy a Medicare Supplement any time of the year, but if you’re not in a Medicare Supplement enrollment period, you’ll have to pass the health questions set by each individual company. Companies determine who they will and will not accept based on their specific underwriting guidelines. Each company set their own guidelines and they will differ company to company. If you have health conditions, it’s all about find the companies that will approve you.

What is a Medicare Select Plan?

Select plans are lower priced supplements that but you may have to use a hospital from that company’s Select Hospital Network. We highly advise avoiding that type of plan if at all possible. One of the biggest reasons Medicare recipients choose a Medicare Supplement (Medigap) instead of a Medicare Advantage Plan is CHOICE.

If you you decide on a “Select” plan you must understand that you cannot go to any hospital or nursing facility that accepts Medicare in the United States. You can only choose your doctors. Keep in mind that if you have a condition and you were told that the best available treatment is for example the Mayo Clinic, you may not be able to go there.

Other Important Things to Consider When Choosing the Best Medicare Supplement

- If you’re not a Medicare Supplement enrollment or a Guaranteed Issue period, you need to find out if you will pass the the health questions. Don’t waste your time looking at rates, increases or ratios until you have it narrowed down to the companies that would likely accept you, and the ones that won’t.

- Maybe you are a snowbird, or plan to be. Some states mandate better benefits, and you may partially or permanently move to another state that the coverage won’t be as good. Everyone’s budget is different. Buying a cheaper plan may be a good idea for one person, but costly in the long run to you.

- A few companies offer additional benefits at no cost that may be important to you, but not the other person. For example, Silver Sneakers could save you $400-500 per year for a health club membership.

- Even if you are in open enrollment for Medicare part B, or in a Guaranteed Issue period, your health conditions may impact the plan you chose today with the great possibility you will want to change in the future (typically because your rates have increased significantly.)

- How well a company pays its claims is virtually a non-issue with a Medicare Supplement. The provider sends the bill directly to Medicare, not the insurance company. Medicare determines how much the service is approved for. Then Medicare pays their portion and notifies the insurance company the amount they are responsible to pay. An insurance company DOES NOT determine what is owed. Whatever the amount Medicare mandates they owe, is what they have to pay.

- Once a company stops accepting new applicants into the demographic category that you are in, the rates will likely increase because there are no new, younger, healthier lives to create a surplus of reserves.

- The plan you have today, maybe the plan you have to keep forever. You probably won’t be as healthy in the future as you are today. If you want to change companies in the future you might not be able to pass the health questions to change again.

- Companies will continually evolve as they close a “book of business”, then open a new one under a subsidiary or sister company. Also, more companies will come into the market and others will leave.

- You will probably want to shop for a better premium every four to five years. Talk to our independent agent when the premiums have increased significantly, or the cost exceeds your budget.

- Medicare Supplement Plan F Plan F is the richest benefit design offered and provides first dollar coverage, meaning that there are no deductibles, co-pays or coinsurance. All benefits that are approved by Medicare are covered at 100%. The government believes that this costs Medicare too much money. Most of the time, the F plan isn’t worth the extra money your spending to cover the Medicare Part B deductible. Plan F is only available if you had Medicare Part A prior to January 1, 2020 and normally costs a lot more than plan G. If you are turning 65 or already 65 but did not earn Part A before 2020, you are not eligible for plan F with any company.

Fill out the Customized Quote Form to get detailed information on rates, rate increase history and A.M. Best ratings for these companies:

- Aetna

- Bankers Fidelity

- Lumico

- Medico

- Accendo

- Anthem

- Mutual of Omaha

- Transamerica

- Prosperity Life

- United American

- Cigna

- Capital Life

- Atlantic Coast Life

- Central States Indemnity

- Manhattan Life and Western United Life

- Humana

- Sentinel Security

- United Commercial Travelers

- Heartland National Life

- Great Southern Life

- Americo

- Garden State Life

- Medical Mutual

- Nassau Financial Group

- Pan American Life

- New Era and Philadelphia American

Best Medicare Supplement Companies by state